You borrow 20000 to make that kitchen all spiffy and new and you have 5 years to pay back the loan. When you take a loan from your 401k it must be repaid with interest.

The 401k Loan How To Borrow Money From Your Retirement Plan Gen X Finance

Instead the interest is paid back into your 401 k account.

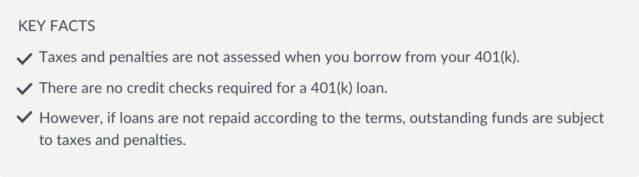

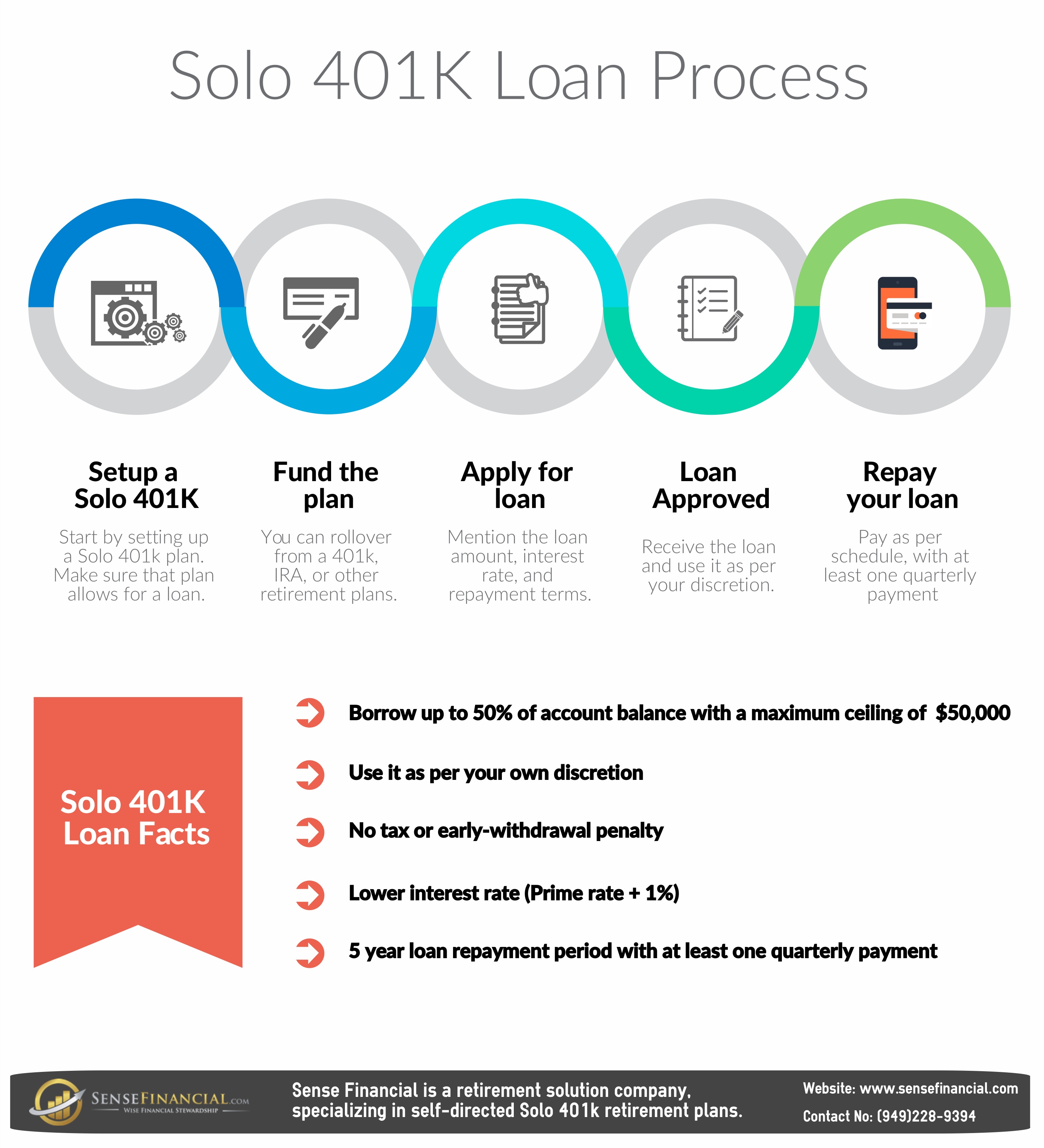

401k loan interest rate. Therefore any new solo 401k participant loans would be subject to the 475 375 plus on point interest payment. Its also a good option if your credit score is. Therefore any interest paid on the loan gets paid to yourself via your 401k account.

Aside from the opportunity cost of missing years of tax-deferred compounding 401k loans are not free. Granted the interest rate is typically less than a conventional loan but as well outline below this is. The new prime rate of 375 only affects new 401k participant loans not prior loans because when you borrow from a solo 401k plan the interest rate stays fixed during the life of the solo 401k participant loan.

Your 401k loan interest rate is prime 1 so that means the interest rate youll pay on your 401k loan is 425. If you do pay interest it goes right back into the account. In a September 12 2011 IRS phone forum IRS personnel stated informally.

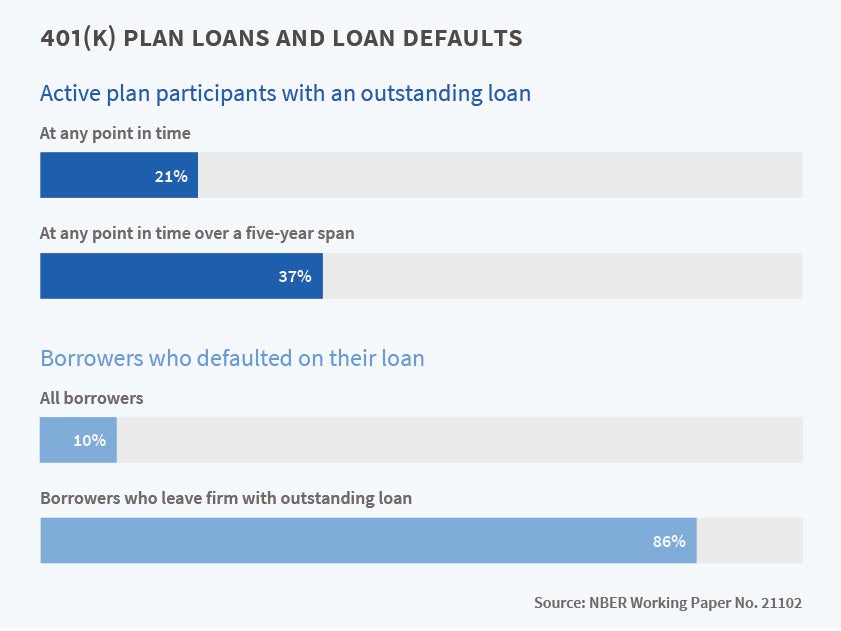

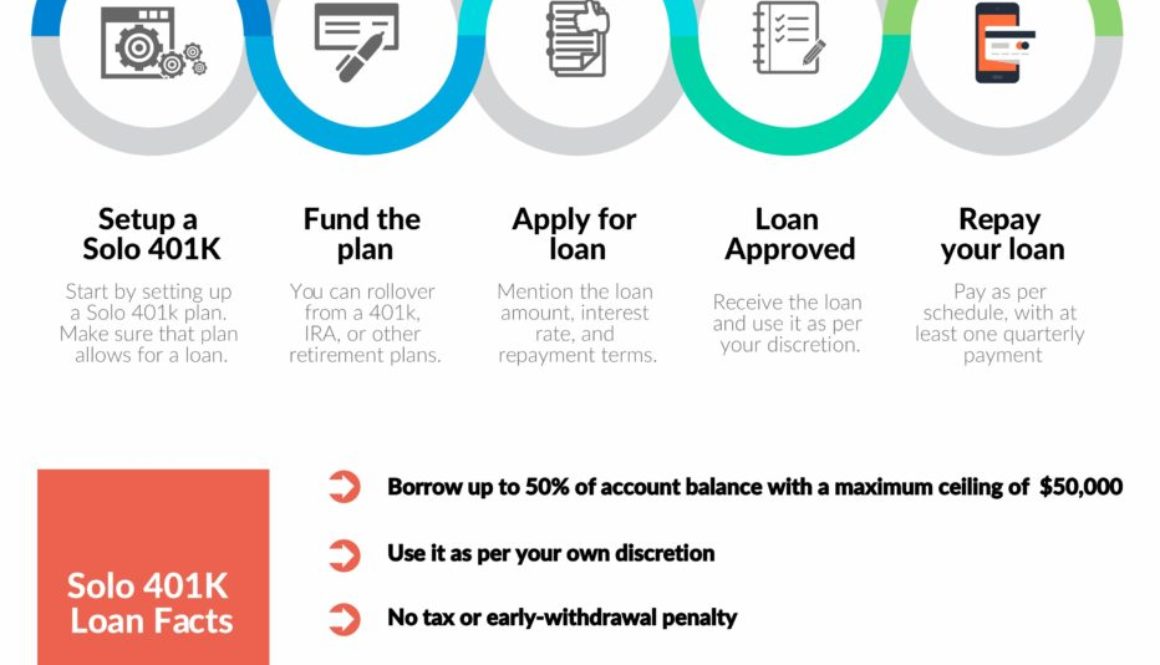

Like most loans except maybe those from Mom and Dad a 401 k loan comes with interest. By law individuals are allowed to borrow the lesser of 50000 or 50 of the total. Actually it is almost too easy.

Right now the prime rate sits at 55 so your 401 k loan rate will come out between 65 and 75. With a 401k loan you borrow money from your retirement savings account. The interest rate for the 401 k loans is usually a point or two higher than the prime rate but they can vary.

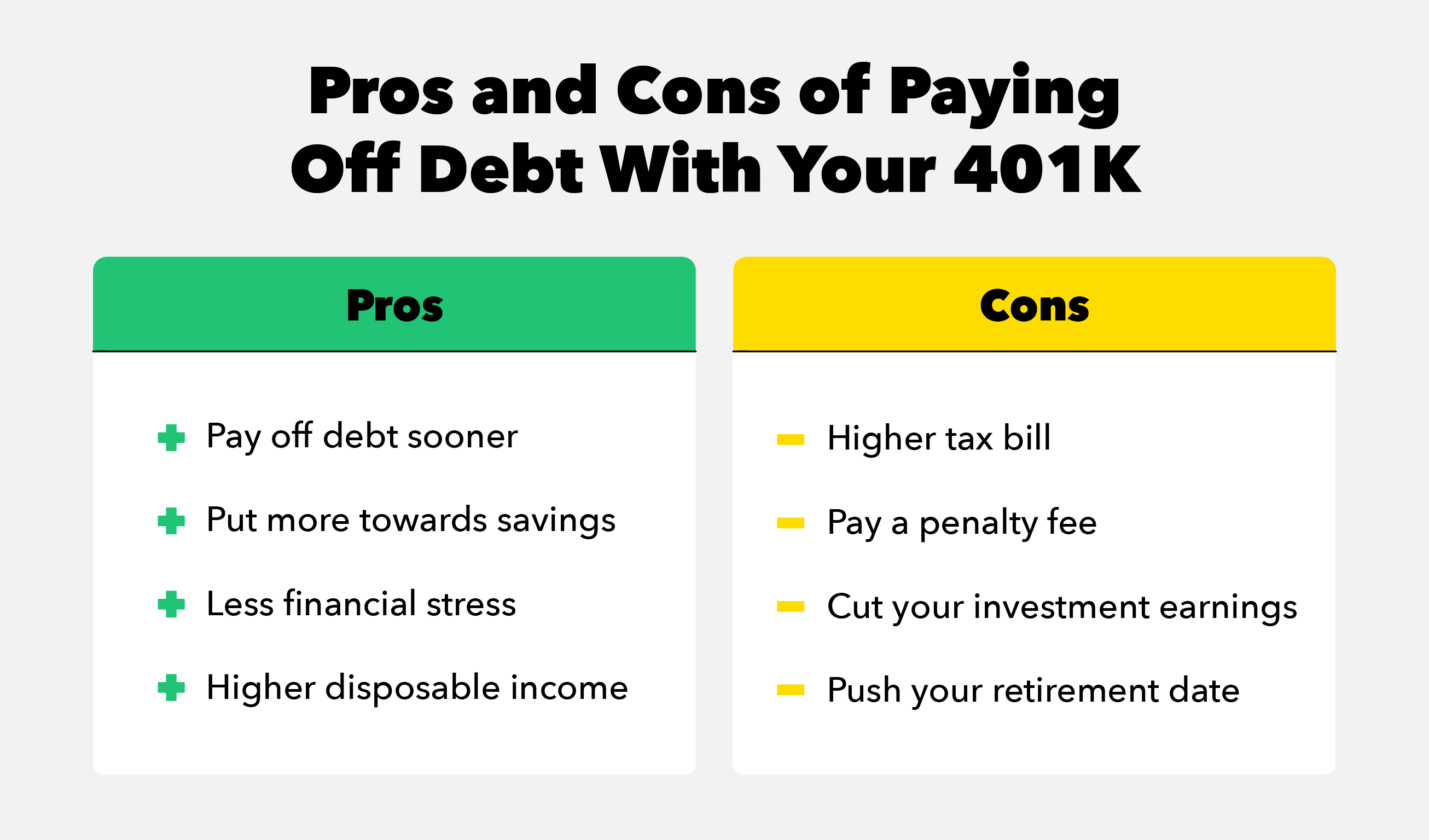

Lets say furthermore that your effective tax rate is 25. How long will I have to pay off a 401 k loan. Remember youll have to pay that borrowed money back plus interest within 5 years of taking your loan in most cases.

As a general rule the Service generally considers prime plus 2 as a reasonable interest rate for participant loans. Borrowers will need to repay the loan with interest. Thats a pretty good price to pay for money.

Weve also seen plans that charge a flat percentage regardless of what the prime rate is. Your entire retirement may depend on the precedent set by you on this matter. 401k loans are fairly easy if your employer offers it.

Please remember you are borrowing from your future. Taking A Fidelity 401k Loan Pros Cons. Your loss rises to.

Your 401 k portfolio. Qualify for another exception. The 401k loan interest rate you pay varies from plan to plan but it is quite common for plans to charge 1 over the federal prime rateSo if prime is sitting at 6 your loan interest rate will be 7.

Any unpaid loan amount also means youll have less money saved for your retirement. If loan is not repaid you face additional taxes and a 10 percent penalty. Are at least age 59 or.

Something else to note about 401k loans is that not all plans permit them. You may also have to pay an additional 10 tax on the amount of the taxable distribution unless you. Depending on what your employers plan allows you could take out as much as 50 of your savings up to a maximum of 50000 within a 12-month period.

The rate is usually a point or two above the prime rate. Should I borrow from my 401 k plan. In most cases a 401k loan will be a fixed interest rate loan but check with your employer for specifics.

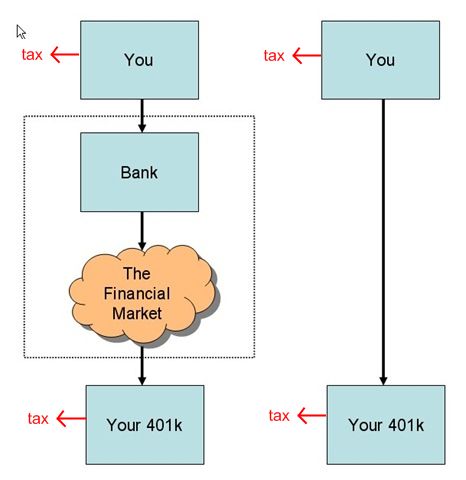

Granted youre repaying the loan back to yourself and the interest rate may be low but its not free money. The interest rates on most 401 k loans is prime rate plus 1. Since youre borrowing your own money the interest isnt paid to a lender.

Beyond the appeal of the relative ease of getting a 401k loan without loan underwriting or credit score requirements and what is typically a modest 401k loan interest rate of about 5 to 6 at least in todays low-yield environment some conservative investors also periodically raise the question of whether it would be a good idea to take a 401k loan just to increase the rate of return in the 401k. A 401k loan differs from other traditional loans in that you are borrowing the money from yourself. The interest on a 401k loan usually wont exceed the prime rate by more than two points but that number can vary.

Cost of Consumer Loan Interest Lost Investment Earnings Lets say you could take out a bank personal loan or take a cash advance from a credit card at an 8 interest rate. If loan is repaid on time you will lose.

401 K Loans Taxes Fees When To Borrow From Retirement

Here S What Happens To Your 401 K Loan If You Are Laid Off

Solo 401k Loan Individual K Loan 401k Borrowing

How To Borrow From 401 K Guide Everything You Need To Know About 401 K Loans Rules Calculator Interest Rates Advisoryhq

Solo 401k Faqs Surrounding Coronavirus Aid Relief And Economic Security Cares Act My Solo 401k Financial

401k Plan Loan And Withdrawal 401khelpcenter Com

Sense Financial Services Solo 401k Infographics

Borrowing Against 401 K S The Real Cost Of 401 K Loans Get Out Of Debt Save More Money And Retire Early Scott Alan Turner

How To Get A 401 K Loan Forbes Advisor

Can You Make Extra Payments On A 401 K Loan To Pay It Off Faster

401k Loan Double Taxation Myth

Should I Cash Out My 401k To Pay Off Debt Take Point Wealth

401k Layoff Trap How To Repay A 401k Loan

Thinking Of Taking Money Out Of A 401 K Fidelity Institutional

401k Loan Double Taxation Myth

Solo 401k Loan Rules And Regulations My Solo 401k Financial

Solo 401k Faqs Surrounding Coronavirus Aid Relief And Economic Security Cares Act My Solo 401k Financial