57 rows As part of the Paycheck Protection Program the federal government has. Payroll costs as defined in the CARES Act.

Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

If you have not received a Paycheck Protection Program PPP loan before First Draw PPP loans may be available to you.

Whats a ppp loan. Congress passed the Paycheck Protection Program PPP loan as part of the Coronavirus Aid Relief and Economic Security CARES Act to provide fast and direct economic assistance for small businesses and to preserve jobs for Americans. And At least 60 of the proceeds are spent on payroll costs. PPP Loan Direct has joined forces with trusted partners ACAP and The Loan Source.

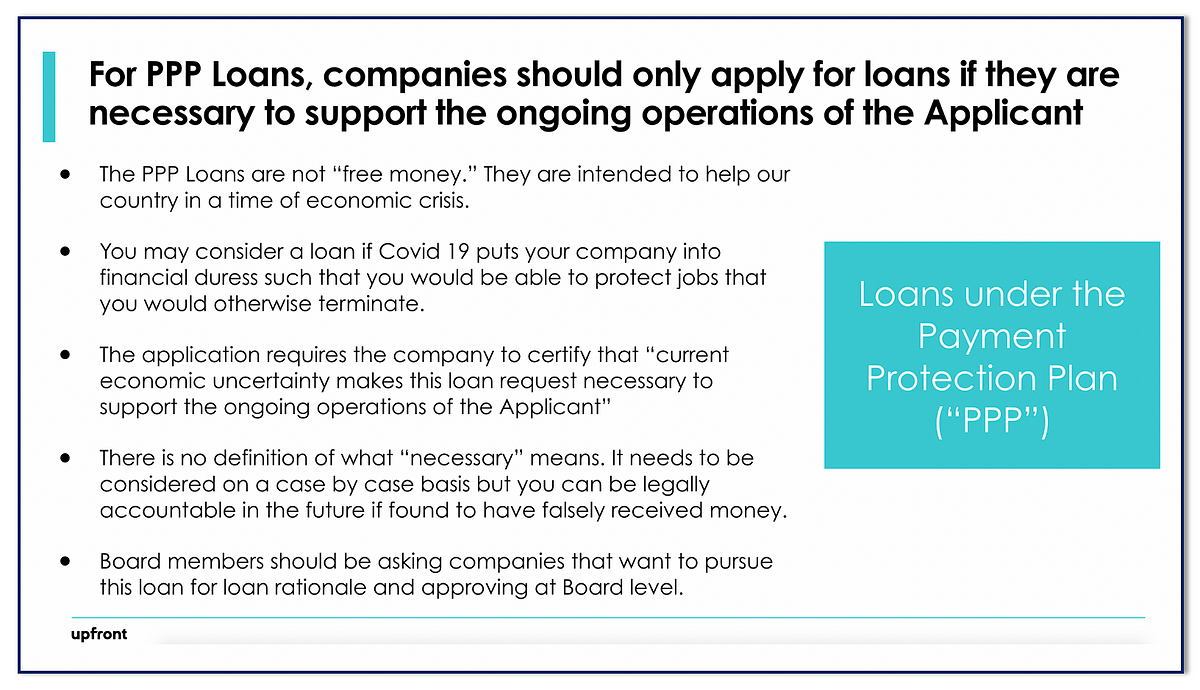

This loan has allowed many small businesses to stay afloat during the sudden economic recession in 2020. The Paycheck Protection Program PPP officially ended on on May 31 2021. PPP is a loan designed to provide a direct incentive for small businesses to keep their workers on payroll.

Paycheck Protection Program Loans How It Works Round 1 The Paycheck Protection Program PPP authorizes up to 669 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. Your loan must still be spent on. PPP Loan Direct is dedicated to helping small businesses like yours access this new round of PPP funds quickly.

If you have previously received a Paycheck Protection Program PPP loan certain businesses are eligible for a Second Draw PPP loan. The date when the SBA remits the amount of forgiveness on your loan. These SBA-approved PPP lenders accepted PPP loan applications while the program was open.

There is further data were working on for the loans under 150k however so check back in. Loan details PPP now allows certain eligible borrowers that previously received a PPP loan to apply for a Second Draw PPP loan with the same general loan terms as their First Draw PPP loan. While it does not have to be filed it must be complete and accurate.

Additional PPP requirements by entity type Independent contractors. The maximum amount for a PPP loan is 25 times your average monthly payroll costs. We make it easy for you to apply for PPP 20 funds even if you dont bank with an approved SBA lender.

A borrower received a PPP loan of 50000 or less If you received a PPP loan that was 50000 or less you are exempt from having to maintain your employee and compensation levels in order to receive loan forgiveness. The proceeds of a PPP loan are to be used for. Second Draw PPP loan.

Or 10 months after the last day of your covered period if you have not applied for forgiveness. Income listed on a Schedule C in your personal tax return is the only payroll that can be used to calculate your PPP loan amount. Employee and compensation levels are maintained The loan proceeds are spent on payroll costs and other eligible expenses.

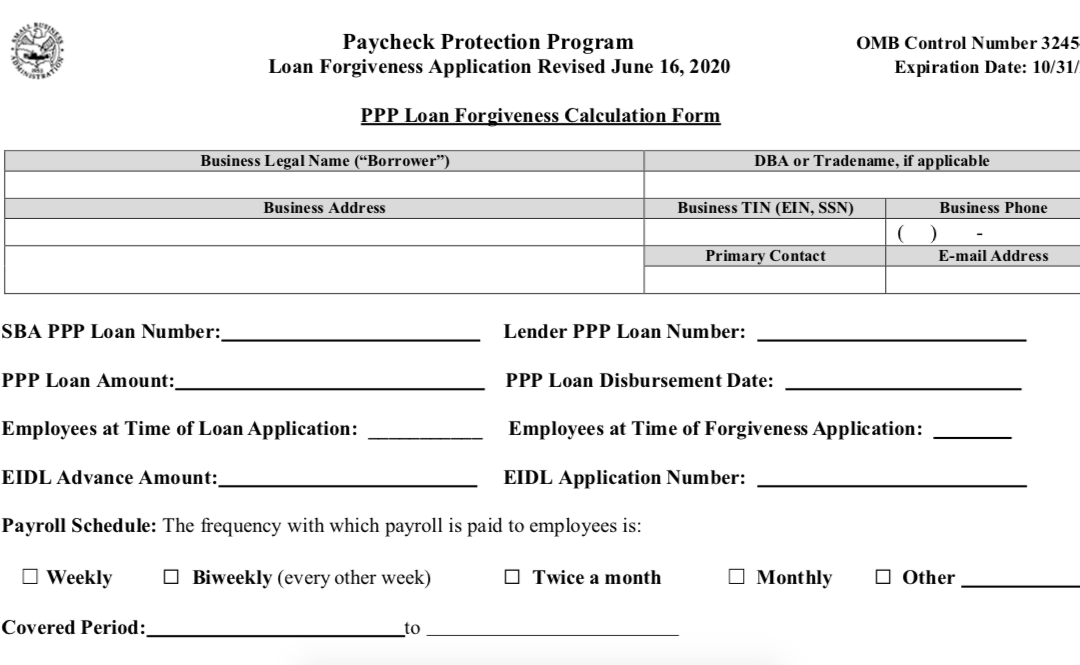

How can PPP loans be used What are forgivable expenses. First Draw PPP loans made to eligible borrowers qualify for full loan forgiveness if during the 8- to 24-week covered period following loan disbursement. Through the Paycheck Protection Program PPP small business owners and other eligible organizations can apply for first-draw loans of approximately 25x their average qualified monthly payroll expenses up to 10 million.

The PPP loan will accrue interest at an annual rate of 1. Consolidated Appropriations Act 2021 into law on Dec. If the PPP loan application for independent contractors is unchanged for 2021 you will need a tax-ready 2019 or 2020 Schedule C from your personal Form 1040 tax return.

No payment is due during the deferral period which ends the earlier of. Browse Search CARES Act PPP Recipients. Once you have either a PPP1 or PPP2 loan its important to understand.

The following data was provided by the SBA US Treasury Department showing a breakdown of all the companies who received loans over 150000. They are the experts in processing PPP. If youve hired 1099 workers they cannot be included in your PPP loan calculation and may apply for their own PPP loans.

Second Draw PPP loans can be used to help fund payroll costs including benefits. A second round of Paycheck Protection Program PPP loans brings many questions around funding eligibility and how the money can be spent to qualify for forgiveness. Are these SBA Preferred Lenders accepting new PPP applications.

Compare traditional business loans instead if your company still needs financing. A third round of Paycheck Protection Program PPP loans was authorized by the passage of HR. All loan terms will be the same for everyone regardless of which lender they use to obtain their loan.

Ppp Loan Statistics Through June 6 2020 Bryan Cave Leighton Paisner Jdsupra

How To Make Sense Of The Ppp Loan Program For Vc Backed Startups By Mark Suster Both Sides Of The Table

New Paycheck Protection Program Ppp Loans How To Qualify And Apply Nav

Paycheck Protection Program Ppp Loan Forgiveness Royal Credit Union

Sba Ppp Loan Approval Statistics Bryan Cave Leighton Paisner Jdsupra

Top Ppp Loan Lenders Updated Approved Banks Providers

Everything You Need To Know About Ppp Loans In 2021 Funding Circle

Ppp Loan Forgiveness Application Simplified Walk Through Form 3508s Youtube